Recently, PricewaterhouseCoopers (PWC) Australia National China Practice and China Chamber of Commerce Australia (CCCA) jointly hosted the 2020 Federal Government Budget Analysis Webcast. PWC National China Practice has insisted on explaining the budget in Chinese for many years, but this is the first time it broadcasted live.。

The live broadcast was hosted by Lou Xuqing, Director of PWC National China Practice, special guest Wang Guannan, Secretary General of CCCA, guest speaker PwC Australia Tax Partner, National China Practice Leading Partner and High Net Worth Service Center-in-charge partner Zhang Kai, tax partner Caleb Khoo, tax director Hou Yuying, and audit business partner Shao Hong. As many as 500 online listeners participated in this live broadcast, and the response was enthusiastic.

Speech by Wang Guannan, Secretary General of CCCA

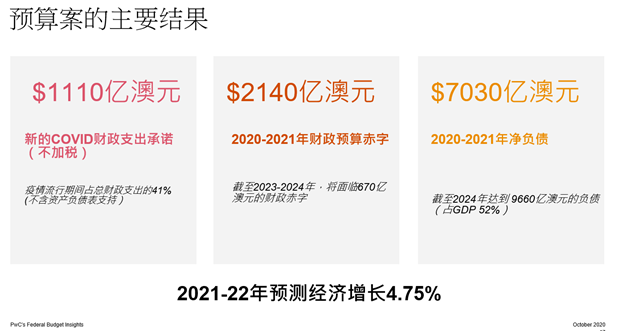

With the severe impact of the pandemic, Australian Finance Minister Josh Friedenberg announced an unprecedented budget to revitalize the Australian economy and reduce unemployment. Mr Zhang Kai made an in-depth analysis on the special government budget under the pandemic to the audience. He divided the interpretation of the government budget into four parts, namely, reviewing the Australian economy before the pandemic, the “V”-shaped recovery of the Australian economy under the pandemic, the important measures of this budget, and the outlook on Australia’s economic transformation and reform path after the pandemic

Regarding government debt, Mr Zhang Kai said that Australia’s government debt ratio accounted for 43% of GDP before the pandemic. The OECD average government debt ratio is around 100%, and the United States and the United Kingdom are at the same level as OECD. The debt ratio announced by China governmentis 50%. So from the perspective of this international comparison, the debt ratio of the Australian government before the pandemic was relatively low which is related to its special national conditions.

Talking about his feelings about the federal budget, Mr Zhang Kai said, “In general, this is a crisis budget. From the perspective of seeking partisan consensus and quickly injecting huge amounts of cash into the economy to ensure employment, the score of this budget is a pass. But overall, the budget measures lack creativity and reformation. The government missed the opportunity to use extraordinary time period to gather public opinion and partisan consensus to challenge some fundamental and structural issues that have long plagued Australia’s economic competitiveness.

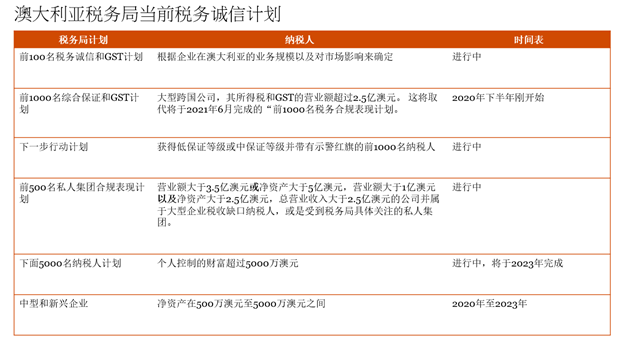

Then, Caleb Khoo, senior tax partner of PWC, provided a recent update on the tax integrity program of the Australian Taxation Office. Caleb said that in the 2019 Federal Budget, the Australian Taxation Office’s task force for tax avoidance of large companies, multinational corporations and high-wealth people received 1 billion Australian dollars funding for operations in the next four years. According to estimates at the time, by 2023, it is expected to bring an additional fiscal revenue of 3.6 billion Australian dollars to the government. The 2020 federal budget does not mention any changes to the 1 billion Australian dollars appropriation, so the Australian Taxation Office will obtain sufficient funds to focus on it various tax integrity programs to meet the tax results of the government budget in the short to medium term

Caleb also elaborated on the current timetable of the Australian tax credit plan and the next action plan.

Next, PwC Tax Director Hou Yuying elaborated on the government tax incentives and mitigation measures mentioned earlier by Mr Zhang Kai. Since March this year, the federal government and state governments have issued a series of tax relief measures to assist companies in coping with the economic challenges by the pandemic. The focus of the measures is to protect jobs, provide cash flow assistance, certain tax relief or deferrals, and encourage investment in assets, thereby encouraging economic recovery.

In addition, Hou Yuying pointed out that for most Chinese-funded enterprises, December 31 is the end of the financial year. By then, the enterprises need to make some preliminary planning. For example, whether the tax losses can be carried forward in full and whether the group has occurred structural changes such as restructuring which will affect the carry-over tax loss test; whether more inventories are impaired or scrapped, and whether bad debts are used as tax deductions before the end of the financial year.

Finally, PWC audit partner Shao Hong provided an update for the 2020 financial reporting to the online audience and made a solid statement on the accounting impact of company insolvency, business continuity, financial instruments, and lease accounting treatment.

In the discussion session, Wei Wei, Director of PWC Australia National China Practice, discussed questions from the online audience with the present speakers. This live broadcast ended with everyone’s active participation and discussion. After the meeting, we got warm feedback and compliment comments.