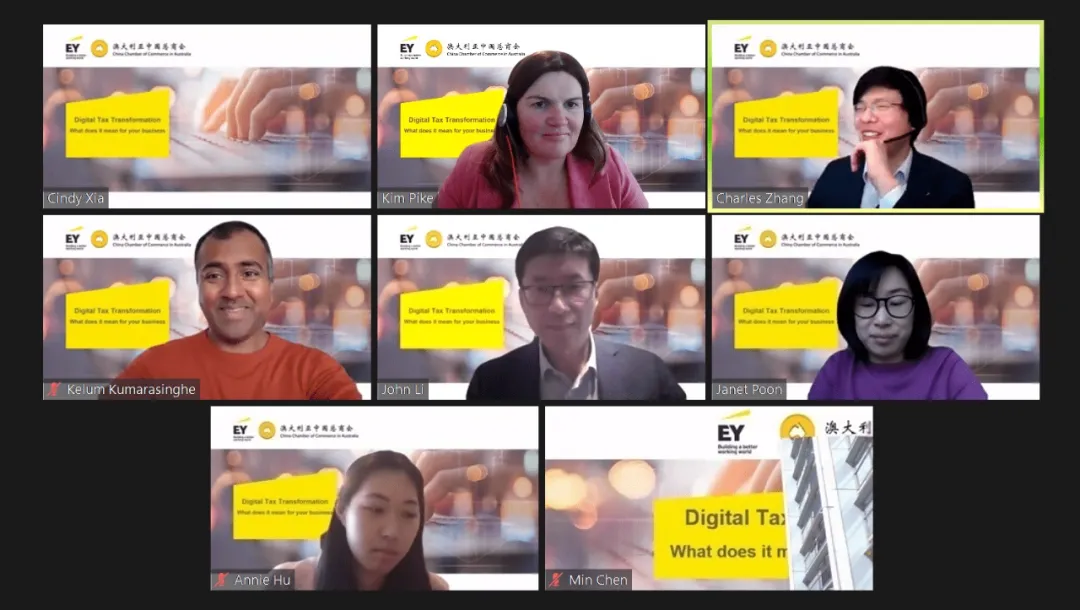

On the afternoon of August 31, 2021, Ernst & Young (EY) Australia and China Chamber of Commerce in Australia (CCCA) successfully held an online seminar. Experts from the EY tax team demonstrated to CCCA members how digital tax transformation applied on corporate taxation and finance to support corporate’s digital transformation strategy.

John Li, EY Oceania China Business Group Leader, presided over the seminar. The General Secretary of CCCA and Chief Representative of Australia of the China Council for the Promotion of International Trade, Chen Min, delivered welcome speech. Mr Chen said, Chinese enterprises in Australia are facing challenges from COVID and this special period of international and geopolitical relations. A few member units have encountered difficulties. CCCA will always be the strong backing of member units and will do its utmost to provide relevant consultations on trade opportunities, investment information, legal advice and market research, and build a solid platform for dialogue between the government and business associations. Through communications with member units, “Compliance Management” is a frequently discussed topic. The Gold Sponsor of CCCA Ernst & Young (Australia) held a seminar on “Tax Digital Transformation”, which is not only a new concept, but also having a profound impact on the business activities of member units of CCCA,

Subsequently, Kelum Kumarasinghe, partner of EY Australia Tax Technology Services, introduced the background of digital taxation and related information on digital taxation supervision. It also emphasizes that digital taxation can not only bring benefits to business, but also an effective way for business to respond to the rapid development of regulatory in this field. At the same time, he also shared the trend of future tax compliance development. Comparing with the current compliance process, there will be changes in the following four aspects in the future:

- The tax declaration and tax refund process that requires a lot of manual participation will be replaced by electronic and automated processes

- The regulators obtains real-time financial and transaction data of the enterprise through the data interface

- Through data analysis, the regulators can grasp the problems and risks in corporate taxation at any time

- The compliance process will realize machine-to-machine docking, basically without human involvement

Kelum suggested that business should increase their investment in tax technology to establish a connected digital tax environment. At the same time, Kelum also introduced some popular tax technology areas: data analysis, data processing automation, end-to-end tax reporting solutions, global tax governance platform, and tax optimization and enterprise-level information extraction.

Then, experts from the EY tax team presented 3 typical tax technology solutions:

- Corporate tax. First of all, Kim Pike, Director of Corporate Tax Advisory Services at EY Australia, showed how EY uses data analysis to ensure tax compliance. Every step is auditable, the entire process is transparent, and every data makes sense. At the same time, data analysis also allows tax person to find problems in the data and key risks and make corrections in a timely manner before completing the tax return. After the compliance process is completed, the data analysis dashboard can be used as an audit trail to respond to subsequent review by the taxation regulators.

- Indirect tax. Secondly, Janet Poon, Senior Manager of Indirect Tax Consulting Services at EY Australia, presented the examples of applying automation and data analysis in the field of Goods and Services Tax (GST). Through the demonstration, it can be clearly seen that automation saves a lot of time for the business, and the human resources of the finance team can be used to engage in more “value-added” work, instead of doing the laborious manual tax filing process. Janet also said that when designing data analysis model, EY followed the GST control and GST data test outline issued by the Australian Taxation Office, and EY can also make corresponding defined functions according to the specific needs of business. Therefore, this solution can not only convert GST-related data into value, but also ensure business can safely deal with possible future GST audits and reviews.

- Tax technology service. Finally, EY Australia tax technology service senior manager Charles Zhang and senior consultant Annie Hu demonstrated EY’s integrated tax management platform-Connected Tax Gateway (CTG). Through CTG, relevant documents, entities, and possible disputes with taxation regulators can be managed, and achieve the governance and monitoring of compliance processes and tax risks. CTG is developed based on Microsoft SharePoint, and has a highly modular design concept, which can be adjusted accordingly to the needs of different enterprises. Through the use of CTG, the existing tax control framework of the enterprise can be greatly strengthened, and the cooperation between the financial and taxation departments within the enterprise can be promoted.

The above are several typical tax technology-related solutions. In the actual project, tax technology-related solutions will be tailored to customers according to the enterprise’s tax situation and specific needs. While solving tax problems and improving efficiency of tax functions, it also creates value for business.

By the end, Kelum advised how EY can help business achieve digital tax transformation in three aspects

- Managed services. Business can delegate one or all of their tax functions to EY. With the professional tax personnel and industry-leading tax technology, EY will help customers realize the transformation of digital taxation.

- Develop corresponding tax technology solutions within customer’s IT environment or infrastructure. For example, EY can collaborate with customer IT departments for data analysis, process automation deployment and install third-party software and debugging.

- Tax-related optimization and debugging on existing systems or software. For example, the tax optimization of the ERP system mentioned earlier and the application of enterprise performance management software (EPM) in the tax field

EY Australia looks forward to have more in-depth offline communication. If you want to know more or have any questions, please feel free to contact a member of our China Desk.

This material is prepared for the purpose of providing general information, and is not intended to be relied upon accounting, taxation, legal or other professional advice. Please ask your consultant for specific advice.

Contact us

EY Australia China Desk Members